Wall Street finally awakes to a “clear and present danger”

February 7, 2018

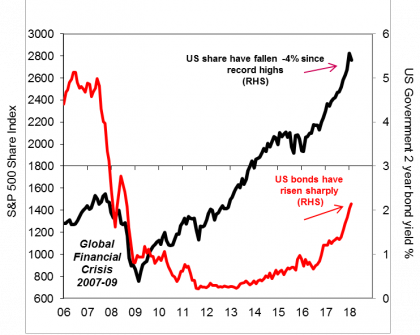

US shares vs Government bonds

Source: Federal Reserve St Louis.

Wall Street has fallen -4% over the past week. This was off the back of record highs on January 26 with the S&P 500 Index peaking at 2872.87 (black line).

What’s behind the share correction? Well the “bears” would argue that US shares were already overvalued on key measures. There was also evidence of ‘irrational exuberance’. Positive investor surveys, high margin debt and the very low VIX volatility readings all indicated elevated levels of optimism.

Yet the primary catalyst for a share correction has been evident for the past six months. The US Government 2 year bond yield has surged from 1.3% to 2.1% currently (red line). Bond markets are increasingly nervous that US inflation pressures are starting to build as wages have risen and the US dollar has weakened. Given there is a new Fed Chair and committee members in 2018, the Fed could easily shock financial markets with a more aggressive interest rate stance. The days of cheap money in terms of low bond yields seemed to be over six months ago. So after Wall Street’s dream run with record highs, US shares seem to have finally awoken to the reality of higher bond yields.

Source: nab asset management 5 February 2018

Author: Bob Cunneen, Senior Economist and Portfolio Specialist

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Powered by WPeMatico