Four real estate trends to watch as economies reopen

June 7, 2021

After a tumultuous 2020, we identify four main trends that will drive real estate this year and in the decade to come. Capital in search of yield should support current pricing, while specialist segments like laboratories will catch the eye of mainstream investors. Environmental concerns will spur more property refurbishment. Finally, political and inflation risks make knowing one’s tenant a cornerstone of sustainable returns.

1. The ‘gravity’ of yield

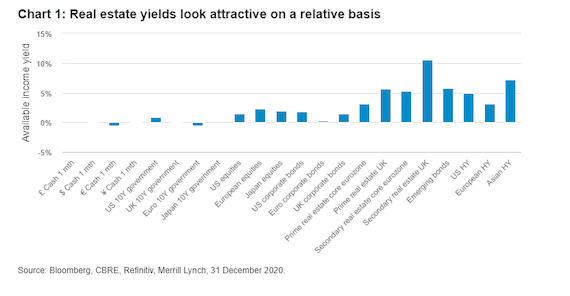

The continued monetary support for economies around the world has made bonds yielding more than one per cent ever scarcer. At the end of 2020, only 38 per cent of global A-rated financial bonds and 45 per cent of A-rated industrial bonds offered more. In contrast, yields on prime real estate assets are around 3 to 4 per cent, often with long, secure income streams from the same companies whose bonds trade well below one per cent.

While some of the yield discount compensates investors for real estate’s illiquidity and depreciation, we believe the real yields on direct real estate will continue to be attractive to many investors relative to other asset classes. This should support continued inflows of capital to real estate markets, particularly the most liquid and transparent markets such as Germany, France and the Netherlands. This capital, when combined with investment deferred from last year, will exert further downward pressure on yields for assets in sectors such as logistics and residential.

The UK may benefit from this trend in 2021. The completion of a free trade deal with the European Union (EU) has removed some perceived risks, particularly around currency. And the roughly 100-basis-point spread between prime assets in the UK and those in similar-sized markets in continental Europe is likely to attract cross-border capital to the UK. Subsectors like last-mile logistics and regional offices are viewed as less exposed to trade disruption and may receive a bigger boost. The impact of non-tariff barriers to trade, however, still needs to play out.

2. Specialist real estate goes mainstream

Mainstream investor interest in specialist real estate sectors, such as data centres, self-storage, life science and healthcare had been growing in the mid-2000s before the 2008 financial crisis reversed much of this activity. But since then these segments have become well established in the real estate investment trust markets. The conditions are ripe for them to benefit from structural trends, such as demographic change and the use of technology, that will act as headwinds for the more traditional sectors of office and retail, which have also been impacted by Covid-19.

This is not without its challenges. Investors stepping into this area face competition from specialist investors and operators, lot sizes that are either at the small or very large end of the spectrum, as well as risks of obsolescence where building specifications are highly specialised. Nevertheless, assets in these sectors should provide diversification and good growth prospects for investors and we expect to see allocations to these specialist sectors steadily increase.

3. ESG becomes a disruptor

Buying new buildings with excellent green credentials is no longer enough. The industry needs to focus urgently on renovating and modernising the existing stock of buildings. Buildings are responsible for 40 per cent of energy consumption and 36 per cent of CO2 emissions in the EU. To meet the Paris Accord targets, commercial real estate will need to reduce its CO2 by more than 80 per cent by 2050.

For the real estate industry, the Global Real Estate Sustainability Benchmark (GRESB) rating framework has been key in driving real estate investors to put in place environmental, social and governance (ESG) policies, institute good practice, and capture data on utility use and waste recycling. However, there are growing concerns about ’greenwashing’ and investors are focusing on evidence of clear impacts. We expect new frameworks and targets to emerge to help measure impact, changing the way assets are assessed, monitored and managed.

This shift to a focus on impact may also provide some opportunities. There is evidence that pricing currently reflects a ‘brown discount’ for older assets with no ESG certification, but these properties could potentially deliver measurable impacts if they can be refurbished to good sustainability standards.

4. The importance of ‘know your tenant’

The pandemic focused minds on rent collection and tenant defaults. It showed the importance of a ‘know your tenant’ – or KYT – investment approach for delivering sustainable income. The quality of the asset and the length of the lease are no substitute for a well-capitalised tenant with a good business model in a resilient sector, which will be key to delivering attractive performance throughout the 2020s.

This is because some longer-term themes are coming into view as the focus turns to the reopening of economies. Most immediate is the growing political risk in the eurozone. The resignation of governments in the Netherlands and Italy, a change of leadership in the ruling party in Germany, and preparations for elections in France in 2022 all create uncertainty. The impact of political risk on the way governments chart a path out of lockdown, deliver a fast and effective roll-out of the vaccines and continue to support the economy will affect the speed of recovery.

Inflation is a further risk that may occur within three to five years, following a combination of supportive fiscal and monetary policy, a shift in central banks’ inflation targeting methodology and deglobalisation. Real estate investors need to consider the implications of these risks for portfolio construction, particularly when looking at lease lengths and indexation clauses.

Call us on 02 4342 1888 to discuss further.

Source: Fidelity April 2021

Reproduced with permission of Fidelity Australia. This article was originally published at https://www.fidelity.com.au/insights/investment-articles/four-real-estate-trends-to-watch-as-economies-reopen/

This document has been prepared without taking into account your objectives, financial situation or needs. You should consider these matters before acting on the information. You should also consider the relevant Product Disclosure Statements (“PDS”) for any Fidelity Australia product mentioned in this document before making any decision about whether to acquire the product. The PDS can be obtained by contacting Fidelity Australia on 1800 119 270 or by downloading it from our website at www.fidelity.com.au. This document may include general commentary on market activity, sector trends or other broad-based economic or political conditions that should not be taken as investment advice. Information stated herein about specific securities is subject to change. Any reference to specific securities should not be taken as a recommendation to buy, sell or hold these securities. While the information contained in this document has been prepared with reasonable care, no responsibility or liability is accepted for any errors or omissions or misstatements however caused. This document is intended as general information only. The document may not be reproduced or transmitted without prior written permission of Fidelity Australia. The issuer of Fidelity Australia’s managed investment schemes is FIL Responsible Entity (Australia) Limited ABN 33 148 059 009. Reference to ($) are in Australian dollars unless stated otherwise.

© 2021. FIL Responsible Entity (Australia) Limited.

Important:

This provides general information and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances before deciding what’s right for you. Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

The post Four real estate trends to watch as economies reopen appeared first on MLC Contemporary.

Powered by WPeMatico