Faster than the wind – how mandatory super contributions help Australians get ahead

December 1, 2017

There’s a lot of debate in the superannuation industry about what constitutes an ‘adequate’ contribution rate.

Most experts say somewhere around 12-15 percent over a full working life should provide retirees with a decent nest egg. And indeed, the Australian super system is heading to a 12 per cent mandatory super guarantee (SG) rate by 2025, assuming no more government tinkering.

As many investors will only have been getting 9 per cent or less for most of their working lives, a lot of time is spent figuring out ways to encourage members to engage more with their super and make additional contributions.

But is equating member engagement with more voluntary contributions really such a big issue?

Let’s look at the evidence from How Australia Saves — Vanguard’s recent collaboration with Sunsuper that offers some fascinating insights into the experiences and behaviour of 1.1 million members in one of Australia’s biggest super funds.

Half full or half empty…

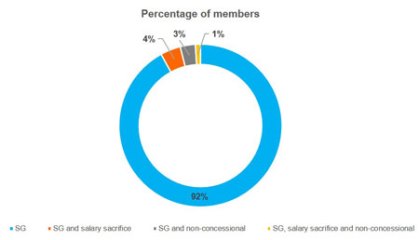

As you can see in the chart below, in 2016 the vast majority of members only had their employer SG contribution, which has stood at 9.5 per cent since 2014-15.

Relatively few members—around 8 per cent in total—supplemented this with any voluntary contributions, whether salary sacrifice or non-concessional, or both. .

How Australia Saves 2017: Contribution types, 20161

Now, it’s fair to say that just 8 per cent making voluntary contributions doesn’t sound great. And in the finance industry we tend to use this sort of statistic as evidence of widespread member disengagement and mass apathy.

But let’s flip it for a second. Looked at another way, we can see that 92 per cent of active Sunsuper members are getting at least 9.5 per cent of their salaries into their retirement savings. And they are on a path to getting 12 per cent by 2025.

So the big message here is the power of default contribution settings in Australia. Even for members who do nothing, the system delivers them at least 9.5 per cent of their salaries – and even more if they qualify for additional measures such as the Low Income Tax Offset (LITO) or Government co-contribution scheme.

Finding a balance

This opens up an interesting debate about finding the right balance between compulsion and voluntary participation.

As a comparison, let’s turn to a country where contributing to retirement savings is generally entirely voluntary.

Our flagship US research publication, How America Saves, looks at 4.4 million participants in Vanguard defined contribution (DC) retirement plans.

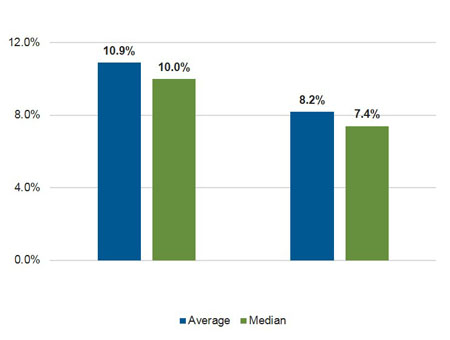

Average contribution rates: Vanguard DC plans permitting employee-elective deferrals2

As you can see in the chart above, the median contribution rate in 2016 was 10 per cent. This sounds healthy until you realise that it includes both participants (members) and employer contributions.

If we include members who could have contributed but chose not to, the median rate drops to 7.4 per cent.

So the near universal 9.5 per cent contribution rate in Australia is looking pretty good—especially as it all comes from the employer.

On your marks…

One way of looking at member engagement is a yacht race, with the finish line as some notion of ‘adequacy’—let’s say a 12-15 per cent contribution rate.

Over in the US there’s feverish activity in pre-race tacking and maneuvering just to get to the starting line.

The Australian team is already there, thanks to our mandatory 9.5 per cent SG, which acts a bit like the famous winged keel that propelled us to success in the 1983 America’s Cup.

Of course, this is not to say we should be complacent. And anything we can do to encourage members to boost their contributions can only be a good thing – as How Australia Saves confirms.

If you seek further assistance and information please contact us on |PHONE|

1 Source: Vanguard using Sunsuper data, 2017

2 Source: Vanguard, How America Saves 2017

Source: Vanguard 13 November 2017

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2017 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business, nor our Licensee take any responsibility for any action or any service provided by the author.

Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.

Powered by WPeMatico