Chart of the week: Wall street’s sentiment is all ‘trumped up’ again.

September 12, 2018

06 September 2018

Bob Cunneen, Senior Economist and Portfolio Specialist

US shares vs Sen

Source: Federal Reserve Bank of St Louis and Reuters Datastream.

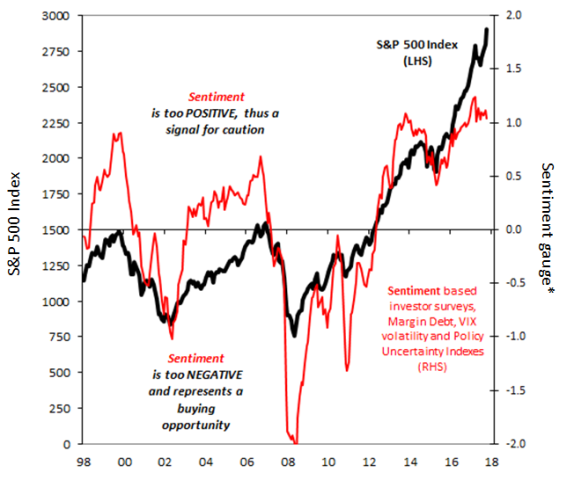

Wall Street achieved record highs last week for the benchmark S&P 500 Index (black line). This extraordinary rally has seen the US share market more than quadruple in price since the lows of March 2009. A pantheon of positives are cited as supporting US shares – the strong US economy, moderate wages and inflation pressures, gradual interest rate rises and the corporate tax cuts. Given these favourable tailwinds, corporate profits have surged by a remarkable 25% over the past year to June 2018 (according to Factset).

However there are warning signs that US shares are becoming all too exuberant. Investor surveys and market positioning measures show that the optimism on US shares is very high. This sentiment gauge* (red line) is also notably above the share market peaks of 2000 and 2007.

Wall Street may seem a safe haven given the current turbulence in emerging markets such as China, Argentina and Turkey. However the high US sentiment gauge result suggests that investors appear overly confident of Wall Street’s prospects.

*Sentiment gauge based on VIX volatility, household share holdings, Sentix investor survey, Margin Debt and Policy Uncertainty Index.

Source : Nab nabassetmanagement September 2018

Important Information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Powered by WPeMatico