Chart of the week: The Fed is still talking up interest rates

October 9, 2018

Bob Cunneen, Senior Economist and Portfolio Specialist

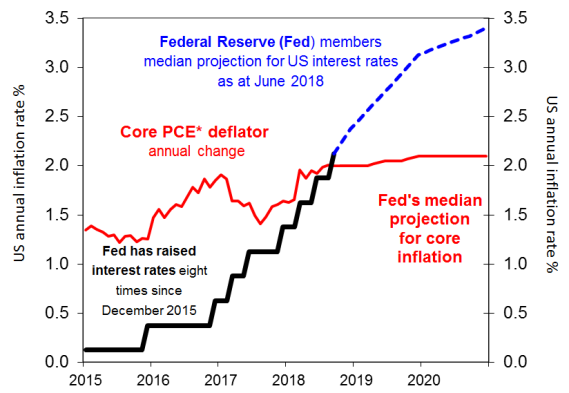

US Fed’s interest rate and inflation projections

Source: US Federal Reserve

*PCE – Personal Consumption Expenditures

The Federal Reserve (Fed) raised US interest rates by 0.25% to a new 2% to 2.25% range at September’s meeting. This is the eighth US interest rate rise since December 2015. The primary reason given for higher interest rates is that the US economy is “strong”. US economic growth was above 4% in the June quarter while the unemployment rate is below 4%.

The Fed has also provided guidance that US interest rates should continue to rise with another 0.75% increase projected in 2019 and a further 0.25% in 2020 (dotted blue line). This projected path has been described by the Fed as involving only “gradual” rises in interest rates towards 3.4%.

However the Fed’s guidance is not a guarantee that future US interest rate rises will be gradual. US inflation risks are also building as seen in higher US wages growth and rising oil prices. The US annual inflation rate (red line) was running at 2% in July as measured by the core Personal Consumption Expenditures deflator. For both borrowers and investors, this projected “gradual” climb in interest rates could actually become more forceful should US inflation pressures accelerate. Both Main Street and Wall Street need to be mindful that the Fed’s “gradual” may turn out to be rather painful.

Source : Nab nabassetmanagement 28 September 2018

Important Information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Powered by WPeMatico