Chart of the week: The Australian dollar still needs to ‘Mind the Gap’ on interest rates

July 6, 2018

5 June 2017

Bob Cunneen, Senior Economist and Portfolio Specialist

Australian dollar vs interest rate gap

Sources: Reserve Bank of Australia and Federal Reserve Bank of St. Louis.

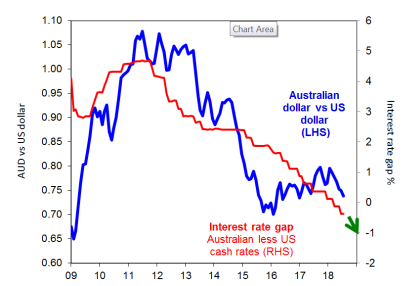

The Australian dollar (AUD) has been surprisingly resilient against the US dollar (blue line) for the past financial year. The AUD has managed to trade in a narrow range between 0.73 and 0.81 cents. For a currency which is sometimes known as the Pacific Peso, this has been a remarkably stable performance.

Currently Australia’s cash interest rate is only 1.5% compared to the equivalent US Federal Funds rate at 1.88%. Effectively, Australia’s cash rate is only marginally below the US with a negative interest rate gap of -0.38% (red line).

However the AUD is likely to come under pressure over the coming months. The US Federal Reserve (Fed) provided guidance at its June meeting that “further gradual” increases in US interest rates should be expected. The Fed projects another two interest rate increases totalling 0.5% this year. By contrast, the Reserve Bank of Australia seems stuck in neutral with no guidance for any move in interest rates. With the Fed raising US interest rates, the interest rate gap could move towards -1% by the end of 2018 (green arrow). So this interest rate gap is set to become an even larger chasm for the AUD to navigate.

Source :Nab assetmanagement 5 July 2018

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Powered by WPeMatico