Chart of the week: Should the Reserve Bank cut interest rates to support Australia’s economic growth?

May 10, 2019

8 May 2019

Bob Cunneen, Senior Economist and Portfolio Specialist

RBA cash interest rate vs leading indicators

Source: Reserve Bank of Australia and Datastream.

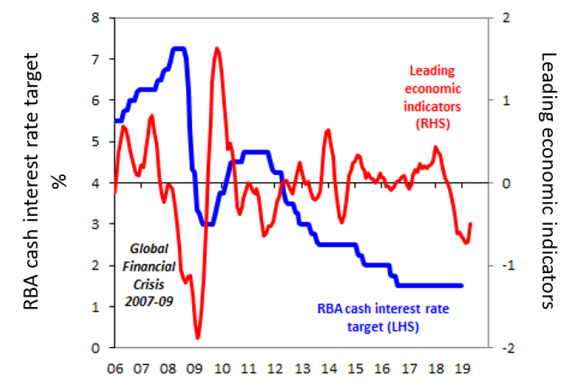

The Reserve Bank of Australia (RBA) is under considerable pressure to cut interest rates. This seems extraordinary given that Australia’s cash interest rate stands at a low 1.5% (blue line). However there seems to be a strong case to cut interest rates further given Australia’s current economic growth is sedate and inflation is subdued.

Australia’s economic growth appears to have slowed to a crawl since the middle part of 2018.The leading economic indicators provide a guide to whether economic growth is accelerating or slowing. Recently these leading indicators have been very disappointing (red line). Soft business surveys, weak housing construction and falling car sales suggest the Australian economy is struggling.

However the evidence is not yet conclusive. These leading indicators may overstate the economy’s weakness given that they do not capture strong infrastructure spending and improving business investment prospects. The Federal Budget’s income tax cuts for low to middle income earners could also prove very beneficial to consumer spending. Australia’s labour market also remains solid with strong jobs growth and the unemployment rate remaining stable at 5%.

To avoid a rush to judgement, the RBA is likely to spend the next few months weighing up all this conflicting evidence on whether cutting interest rates is justifiable.

Source : Nab assestmanagement May 2019

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Powered by WPeMatico