Chart of the week: Is the Federal Reserve “crazy” or just President Trump’s budget plans?

October 24, 2018

19 October 2018

Bob Cunneen, Senior Economist and Portfolio Specialist

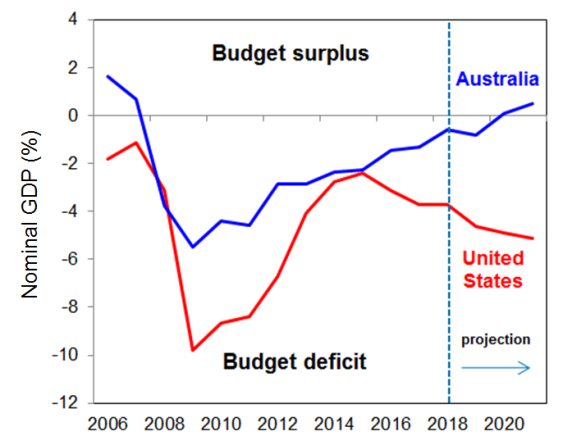

Budget balance as percentage of Nominal GDP

Source: Final Budget Outcome 2017-18, ‘Appendix B: Historical Australian Government data’, www.budget.gov.au/2017-18/content/fbo/html/, accessed on 18 October 2018.

President Trump made extraordinary remarks over the past week suggesting that the US central bank “has gone crazy” by raising US interest rates. However the old adage applies here ‘when you point the finger of blame, there are always three fingers of your hand pointing back at you’.

The Fed is raising interest rates because the US economy is performing strongly and inflation risks are rising. Adding further fuel to the US economic furnace is President Trump’s budget stimulus. Given large corporate and personal tax cuts were implemented this year, the US budget deficit is set to sharply deteriorate. The US Federal budget’s annual deficit was US$779 billion in the year to September 2018. This equates to approximately -3.7% of US Nominal GDP (red line). The Congressional Budget Office is projecting the US budget deficit will significantly increase towards -4.9% GDP in 2021.

By contrast, Australia’s Federal budget is grinding towards a surplus. In the last financial year 2017/18, Australia’s budget deficit narrowed to A$10.1 billion which equates to approximately 0.6% of GDP (blue line). Providing Australia’s economy performs solidly and the Federal Government maintains some fiscal discipline over the coming year, there is even the possibility that an Australia budget surplus could appear only 12 years after the last one, way back in 2008.

Source : Nab assetmanagement October 2018

Important Information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Powered by WPeMatico