Chart of the week: Is Australia in a credit crunch?

October 12, 2018

05 October 2018

Bob Cunneen, Senior Economist and Portfolio Specialist

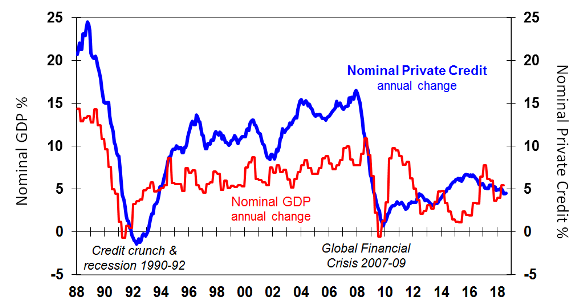

Australian credit and economic activity

Source: Reserve Bank of Australia.

Recent media articles* have suggested that Australia could be facing a ‘credit crunch’. Tighter lending standards for housing appear to be restraining credit availability. If credit has become hard to access, this would suggest potential downside risks for Australia’s future economic growth.

While there is no accepted definition of a ‘credit crunch’, typically this involves a very sharp and sudden reduction in available credit. Credit becomes so restrictive that economic activity struggles to continue growing. Australia has experienced some painful ‘credit crunches’ before. Australia’s 1990/91 recession is a prime example of a credit crunch. The potent combination of problems in commercial property and troubles in the respective state banks of South Australia and Victoria in the early 1990s magnified into a sharp slowdown in credit growth (red line) and economic growth (blue line). The Global Financial Crisis (2007/09) can also be considered a ‘credit crunch’ with a similar sudden slowdown in both credit and economic growth in Australia.

Currently, Australia’s total credit growth is running at a subdued annual pace of 4.5% which is just below nominal economic growth at 5%. However this does not appear to be a sharp and sudden slowdown in total credit that matches a ‘crunch’. Australia’s credit growth has generally been modest and restrained over the past decade. So on the available data, Australia seems to be now experiencing a selective squeeze on housing investors rather than a broader ‘credit crunch’ for all borrowers.

*Recent media articles:

The Australian Financial Review, (2018, 1 October). RBA, Treasury warn regulatory response to Hayne commission risks credit crunch

ABC, (2018, 1 October). Banking royal commission: Will the credit squeeze become a credit crunch?

Source : Nab nabassetmanagement 5 October 2018

Important Information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Powered by WPeMatico