Chart of the week: “Back to the future” on share volatility

February 15, 2018

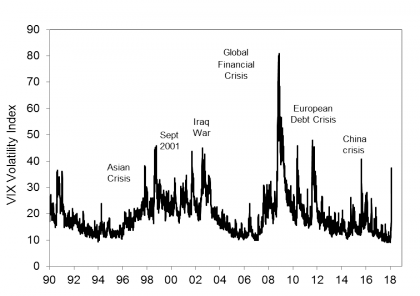

VIX Volatility Index

Source: US Federal Reserve, St Louis

US shares have been in turmoil since February 2nd. The announcement that US wages growth had accelerated to its fastest pace since 2009 was the catalyst for this sharp share selloff. However this US inflation surprise was actually magnified into a shock due to complacency about volatility.

Indeed there was a notable absence of fear in financial markets. Even the ‘fear gauge’ known as the VIX was trading at a tranquil 12% on January 31st. The VIX is an option pricing measure of US share market volatility over a one month time horizon. Any concerns about US inflation risks or North Korea or even Middle east tension were just concerns rather than potential catastrophes.

History reminds us that when fear returns, the VIX volcano erupts. Over the past two decades, there have been numerous episodes of intense share market volatility. The current turmoil has seen the VIX climb to 37.3 on February 5th, its highest close since August 2015 when China devalued its currency. US share investors are hoping this is just a temporary setback, as was the case in 2015.

Yet the high VIX reading presently suggests that the age of tranquillity has passed. US share volatility is now “back to the future”.

Please contact us on |PHONE| if you would like more information.

Source: NAB Asset Management 12 February 2018

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group.

The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice).

MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance.

This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Powered by WPeMatico