Chart of the week: Australia’s economic growth accelerates but watch out for those brakes

June 12, 2018

7 June 2018

Bob Cunneen, Senior Economist and Portfolio Specialist

Global economic activity

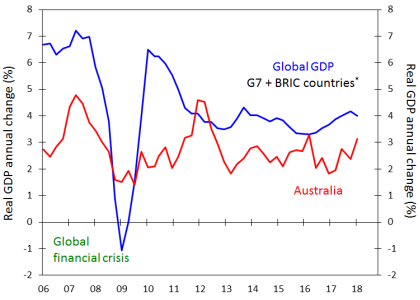

*The countries collectively known as the Group of Seven (G7) consists of the US, Canada, the UK, France, Germany, Italy and Japan. BRIC refers to Brazil, Russia, India and China.

Sources: NAB Asset Management Services Limited, Thomson Reuters, Australian Bureau of Statistics.

After a few years in the slow lane, Australia’s economic growth is accelerating. Australia’s annual growth rate for the year to March 2018 is now registering at 3.1% (red line). Encouragingly, Australia also appears to be finally catching up to global growth which is approaching 4% for the past year (blue line).

However there are some brakes currently being applied to Australia’s growth performance. Consumer spending has recently moderated given the challenges of high household debt and subdued wages growth. The housing construction boom also seems to have peaked. Tighter lending standards, higher interest rates for housing investors and concerns over the potential oversupply of apartments is now providing a speed limit to construction activity.

Even with these brakes, Australia should manage solid economic growth this year. Australia’s interest rates remain low and employment growth is strong. Our export performance will also benefit from stronger global growth. Government spending on transport infrastructure spending is also notably in the fast lane. While the Australian economy can expect to maintain a reasonable growth speed close to 3% in 2018, it’s likely to trail in the wake of faster global growth.

Source : Nab assestmanagement June 2018

Important information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Powered by WPeMatico