Chart of the week: A Turkish bath for global markets?

August 20, 2018

Bob Cunneen, Senior Economist and Portfolio Specialist

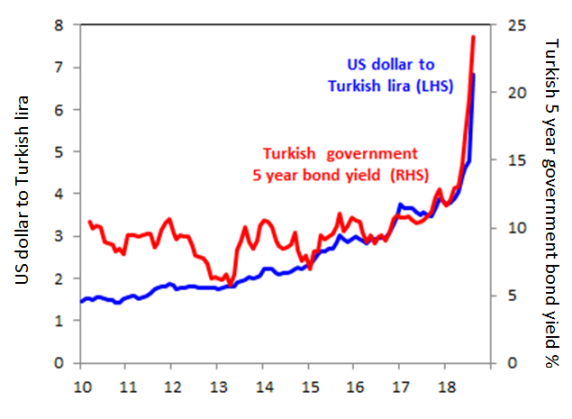

Turkey’s currency vs bond yield

Source: Datastream

Turkey’s financial markets have taken a big bath this year. The Turkish lira has collapsed by 34% against the US dollar this year with the currency now at 5.84 to each US dollar (blue line). Turkish 5 year government bond yields now yield 24% compared to only 12% at the start of 2018 (red line).

Turkey’s financial waters have been warming up for a considerable period. Inflation has been rising and now stands above 15%. Turkey is running a large current account deficit at -6 % of Nominal Gross Domestic product (GDP) that requires supportive capital inflows to finance. Turkey also has significant foreign debt at approximately 53% of GDP.

Turkey is a potential risk to global markets both financially and politically. Turkey is critically important given its proximity to Syria and as a member of Europe’s NATO defence organisation. The financial linkages are even more problematic for Europe. European banks have significant investments and loans in Turkey. The Bank for International Settlements estimates that Spanish, French and Italian bank assets in Turkey were approximately US$138 billion at the end of 2017. So European financial shares are proving acutely sensitive to Turkey’s current turbulence.

A key lesson of the Asian Crisis in 1997-98 with Thailand, and the Global Financial Crisis of 2007-09 with US subprime mortgage securities is that even when small components of the global economy break down, they can have dramatic consequences. The potential contagion risk from Turkey to global markets bears watching by investors.

Source : Nab assetmanagement August 2018

Important Information

This communication is provided by MLC Investments Limited (ABN 30 002 641 661, AFSL 230705) (“MLC”), a member of the National Australia Bank Limited (ABN 12 004 044 937, AFSL 230686) group of companies (“NAB Group”), 105–153 Miller Street, North Sydney 2060. An investment with MLC does not represent a deposit or liability of, and is not guaranteed by, the NAB Group. The information in this communication may constitute general advice. It has been prepared without taking account of individual objectives, financial situation or needs and because of that you should, before acting on the advice, consider the appropriateness of the advice having regard to your personal objectives, financial situation and needs. MLC believes that the information contained in this communication is correct and that any estimates, opinions, conclusions or recommendations are reasonably held or made as at the time of compilation. However, no warranty is made as to the accuracy or reliability of this information (which may change without notice). MLC relies on third parties to provide certain information and is not responsible for its accuracy, nor is MLC liable for any loss arising from a person relying on information provided by third parties. Past performance is not a reliable indicator of future performance. This information is directed to and prepared for Australian residents only. MLC may use the services of NAB Group companies where it makes good business sense to do so and will benefit customers. Amounts paid for these services are always negotiated on an arm’s length basis.

Powered by WPeMatico